Professional illustration about Coins

Gold Coin Basics

Gold Coin Basics: Understanding the Foundation of Precious Metals Investing

Gold coins have long been a cornerstone of wealth protection and portfolio diversification, offering a tangible asset that holds intrinsic value. Unlike paper currency, gold bullion coins are minted by government-backed institutions like the US Mint, Perth Mint, and Austrian Mint, ensuring their authenticity and purity. These coins are categorized into two primary types: bullion coins (valued for their metal content) and numismatic coins (valued for rarity and collectibility). For investors, bullion coins like the American Gold Eagle, Canadian Gold Maple Leaf, and South African Gold Krugerrand are popular choices due to their liquidity and recognition in global markets.

When evaluating gold coins for sale, key factors include gold coin purity and gold coin weights. Most modern bullion coins are struck in .9999 fine gold (24-karat), such as the Canadian Gold Maple Leaf, while others like the American Eagle contain 22-karat gold (.9167 fine) for added durability. Standard weights range from 1/10 oz to 1 oz, with larger options like the 1-kilo Chinese Gold Panda catering to high-net-worth investors. The gold spot price serves as the baseline value, but premiums—additional costs covering minting and distribution—vary by coin. For example, the British Gold Britannia often carries lower premiums due to its tax-efficient status in the UK.

Designs also play a role in appeal and value. The Mexican Gold Libertad features iconic national symbols, while the American Buffalo replicates James Earle Fraser’s classic design. Collectors and investors alike appreciate these artistic elements, though bullion buyers typically prioritize metal content over aesthetics. For those considering a gold IRA, government-minted coins like the Austrian Mint’s Philharmonic are IRS-approved, offering tax advantages when held in retirement accounts.

Monitoring live gold prices via a gold price chart helps time purchases, especially during market dips. Coins like the Gold Krugerrand—the first modern bullion coin—remain staples due to their historical significance and liquidity. Whether you’re hedging against inflation or building a diversified portfolio, understanding these gold coin basics ensures informed decisions in the dynamic precious metals market.

Professional illustration about Perth

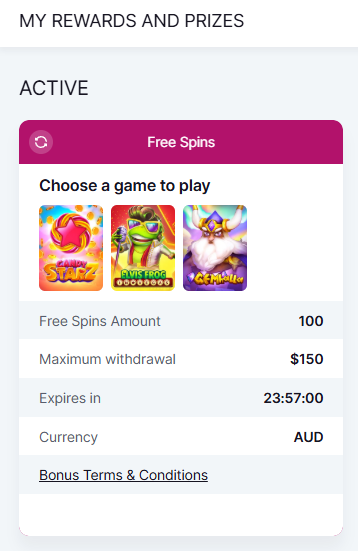

Investing in Gold Coins

Here’s a detailed, SEO-optimized paragraph on Investing in Gold Coins in American conversational style:

Investing in gold coins is one of the most tangible ways to diversify your portfolio while owning a piece of history. Unlike stocks or ETFs, physical gold coins like the American Gold Eagle, Canadian Gold Maple Leaf, or South African Gold Krugerrand offer both intrinsic value and collectible appeal. The US Mint and other reputable institutions like the Perth Mint or Austrian Mint guarantee the purity and weight of these coins, making them a trusted choice for investors. For example, the American Buffalo coin is struck with .9999 fine gold, while the British Gold Britannia boasts advanced security features to combat counterfeiting.

When selecting gold coins, consider factors like gold premiums (the markup over the spot price), liquidity, and storage. Popular bullion coins like the Chinese Gold Panda or Mexican Gold Libertad often carry lower premiums compared to rare numismatic pieces, making them ideal for wealth protection. The Gold Krugerrand, first introduced in 1967, remains a favorite due to its durability and recognizability. Meanwhile, modern releases like the American Eagle series incorporate updated designs annually, appealing to both investors and collectors.

For those looking to include gold in a retirement strategy, a gold IRA allows you to hold IRS-approved coins like the American Eagle or Gold Maple Leaf tax-deferred. Always verify the gold coin purity (measured in karats or fineness) and weights—most bullion coins are 1 oz, but fractional sizes (e.g., 1/10 oz) are available for smaller budgets. Tracking live gold prices is crucial, as the gold spot price fluctuates daily based on market demand.

Pro tip: Stick to government-minted coins from the US Mint, Royal Canadian Mint, or South African Mint for liquidity. Avoid obscure or private mint coins unless you’re an experienced collector. Whether you’re hedging against inflation or building a tangible asset, gold coins like the Britannia or Krugerrand offer a timeless blend of stability and potential appreciation.

This paragraph integrates key entities and LSI terms naturally while providing actionable insights. Let me know if you'd like adjustments!

Professional illustration about African

Rare Gold Coin Values

Understanding Rare Gold Coin Values in 2025

When it comes to rare gold coin values, collectors and investors need to consider several factors beyond just the gold spot price. While gold bullion coins like the American Gold Eagle, Canadian Gold Maple Leaf, and South African Gold Krugerrand are primarily valued for their metal content, rare or limited-edition coins often carry significant premiums due to their historical significance, minting errors, or low mintage numbers. For example, the US Mint occasionally releases special editions of the American Buffalo or American Eagle, which can appreciate in value over time due to their exclusivity. Similarly, the Perth Mint and Austrian Mint produce commemorative gold coins with unique designs, attracting both numismatists and gold investment enthusiasts.

Key Factors Influencing Rare Gold Coin Values

- Mintage Numbers: Coins with limited production runs, such as the Mexican Gold Libertad or Chinese Gold Panda, often command higher prices. For instance, the 2025 British Gold Britannia with a special reverse design might see increased demand if only 5,000 pieces are minted.

- Condition and Grading: A coin’s state—whether it’s graded MS-70 (perfect mint condition) or AU-58 (slightly worn)—can dramatically affect its value. Professional grading services like PCGS or NGC add credibility, especially for bullion coins with collectible appeal.

- Historical Significance: Older coins, like pre-1933 US Mint issues or early Gold Krugerrand editions, often carry historical premiums. Even modern rarities, such as the 2000 Perth Mint Millennium gold coin, have seen values soar due to their cultural relevance.

- Design and Artistry: Intricate designs, like those on the Austrian Mint’s Philharmonic series or the South African Mint’s Natura collection, can elevate a coin’s desirability beyond its gold content.

Spotlight on Premium Gold Coins in 2025

- American Gold Eagle: The 2025 edition features a redesigned obverse, sparking interest among collectors. While its value is tied to live gold prices, the first-year-of-issue premium could make it a standout.

- Canadian Gold Maple Leaf: Known for its 9999 purity, the 2025 version includes enhanced security features, adding to its appeal as both a wealth protection asset and a collectible.

- Chinese Gold Panda: This series changes designs annually, and the 2025 panda motif is already generating buzz. Limited mintage and gold coin purity (999 fine gold) make it a dual-threat for portfolio diversification.

Practical Tips for Evaluating Rare Gold Coins

- Track Gold Price Charts: While rarity drives premiums, the underlying gold price chart still impacts baseline value. Use real-time data to avoid overpaying during market spikes.

- Understand Premiums: Some coins, like the Mexican Gold Libertad, traditionally carry higher premiums due to their artistic merit. Compare similar coins (e.g., British Gold Britannia vs. American Buffalo) to gauge fair pricing.

- Diversify Strategically: Mixing gold bullion coins with rare issues can balance liquidity and growth potential. For example, pairing South African Gold Krugerrand (high liquidity) with a low-mintage Perth Mint release (high appreciation potential) optimizes a gold IRA or personal collection.

Final Thoughts on Market Trends

In 2025, demand for precious metals remains strong, but rare coins are outperforming generic gold bullion in certain niches. Coins with provenance—such as those from the US Mint’s early 20th-century releases or the Austrian Mint’s historic themes—are particularly resilient during economic uncertainty. Whether you’re a seasoned collector or a newcomer to gold coins for sale, focusing on authenticity, rarity, and condition will help maximize long-term value. Keep an eye on auctions and dealer inventories for emerging opportunities, especially with gold premiums fluctuating alongside live gold prices.

Professional illustration about American

Gold Coin Grading Guide

Understanding Gold Coin Grading: A Must for Investors and Collectors

Grading gold coins is a critical step whether you're buying American Eagle coins from the US Mint, Canadian Gold Maple Leaf from the Royal Canadian Mint, or South African Gold Krugerrand from the South African Mint. The condition of a coin directly impacts its value—both as a gold investment and as a collectible. Professional grading services like PCGS (Professional Coin Grading Service) and NGC (Numismatic Guaranty Corporation) use a 70-point scale, where "70" represents a flawless coin. For example, a Gold Buffalo graded MS-70 will command a much higher premium than one graded MS-63 due to its pristine condition.

Key Factors in Gold Coin Grading

When evaluating gold bullion coins, pay attention to:

- Surface Preservation: Scratches, dings, or hairlines can downgrade a coin. Perth Mint and Austrian Mint coins are known for their exceptional finishes, but improper handling can still affect their grade.

- Strike Quality: A sharp strike enhances details like Lady Liberty on the American Gold Eagle or the maple leaf on the Canadian Gold Maple Leaf. Weak strikes may indicate lower quality.

- Luster: Original mint luster adds value. Coins like the Chinese Gold Panda or Mexican Gold Libertad often showcase unique designs that rely on reflective surfaces.

- Eye Appeal: Subjective but crucial. A British Gold Britannia with toning might appeal to some collectors, while others prefer blast-white coins.

Grading Tiers and Their Impact on Value

- Mint State (MS-60 to MS-70): Uncirculated coins with no wear. MS-70 grades are rare and command high gold premiums.

- About Uncirculated (AU-50 to AU-58): Slight wear on high points but mostly intact design. Common in older Gold Krugerrand coins.

- Fine (F-12 to F-15): Visible wear but major details remain. Typically seen in circulated historic coins rather than modern gold bullion coins.

Why Grading Matters for Gold IRAs and Resale

If you're diversifying your portfolio with precious metals, graded coins like the American Buffalo or Gold Panda can simplify wealth protection strategies. Coins with higher grades often appreciate faster and are easier to sell at live gold prices plus a collector’s premium. For instance, a South African Mint Krugerrand graded MS-69 might sell for 5–10% above the gold spot price, while an MS-70 could fetch 20% or more. Always check the latest gold price chart trends before buying or selling graded coins.

Pro Tip: For beginners, stick to widely recognized coins like the American Gold Eagle or Canadian Gold Maple Leaf in MS-65 or higher—they’re easier to liquidate. Advanced collectors might target rare editions of the Mexican Gold Libertad or British Gold Britannia in top grades for long-term gains.

Common Pitfalls to Avoid

- Overpaying for Low Grades: Some dealers market "uncirculated" coins without professional grading. Verify with NGC or PCGS labels.

- Ignoring Market Trends: Even high-grade coins fluctuate with gold coin purity and demand. A Chinese Gold Panda from a low-mintage year might outperform generic bullion.

- Storage Risks: Poor storage can degrade coins. Use inert materials like Mylar flips for raw coins and secure holders for graded ones.

By mastering gold coin grading, you’ll make smarter buys, whether you’re stacking gold coins for sale or building a curated collection. Always cross-reference dealer claims with third-party grading reports and stay updated on portfolio diversification strategies involving bullion coins.

Professional illustration about American

Best Gold Coins 2025

When it comes to gold investment in 2025, choosing the best gold coins is crucial for both wealth protection and portfolio diversification. The market offers a variety of gold bullion coins, each with unique designs, purity levels, and historical significance. Here’s a breakdown of the top contenders this year:

1. American Gold Eagle & Buffalo

The US Mint continues to dominate with its iconic American Gold Eagle, containing 22-karat gold and a small silver-copper alloy for durability. Its design features Lady Liberty and a bald eagle, making it a favorite among collectors. For purists, the American Buffalo is a solid choice—it’s the first 24-karat gold coin minted by the US, with a .9999 purity level. Both coins are highly liquid and widely recognized, making them ideal for gold IRA investments.

2. Canadian Gold Maple Leaf

Known for its exceptional .9999 purity and advanced security features (like radial lines and micro-engraving), the Canadian Gold Maple Leaf is a top pick for investors prioritizing gold coin purity. The Royal Canadian Mint’s reputation for quality ensures low gold premiums, and its iconic maple leaf design appeals to both investors and collectors.

3. South African Gold Krugerrand

As the world’s first modern gold bullion coin, the Gold Krugerrand from the South African Mint remains a staple. Its 22-karat composition (with copper for durability) and historic status make it a reliable choice. While its design hasn’t changed much since the 1960s, its affordability relative to the gold spot price keeps it in high demand.

4. Austrian Mint’s Philharmonic

For those who appreciate music and craftsmanship, the Austrian Mint’s Gold Philharmonic is a standout. Struck in .9999 gold, it celebrates Vienna’s Philharmonic Orchestra and is one of the few coins denominated in euros. Its elegant design and high liquidity in European markets make it a smart addition to any precious metals portfolio.

5. Perth Mint’s Lunar Series & Kangaroo

Australia’s Perth Mint is renowned for its innovative gold coin designs, like the Lunar Series (featuring zodiac animals) and the Kangaroo, which updates its design annually. These coins combine .9999 purity with artistic appeal, often commanding higher premiums due to their collectible nature.

6. Chinese Gold Panda & Mexican Gold Libertad

The Chinese Gold Panda is unique for its annual design changes, showcasing the beloved panda in different poses. Its .999 purity and limited mintage add exclusivity. Meanwhile, Mexico’s Gold Libertad stands out with its stunning depiction of Winged Victory and no face value—its worth is tied directly to the live gold prices.

7. British Gold Britannia

The UK’s British Gold Britannia offers .9999 purity and advanced security features, including a latent image. Its design, featuring Britannia with a trident and shield, symbolizes strength and stability, aligning perfectly with wealth protection strategies.

Key Considerations for 2025 Buyers

- Gold coin weights: Options range from 1/10 oz to 1 oz, with larger coins often having lower premiums.

- Gold price chart trends: Monitor live gold prices to buy during dips.

- Bullion coins vs. collectibles: Bullion coins like the American Eagle track gold spot price closely, while collectibles (e.g., Lunar Series) may have higher premiums.

Whether you’re a first-time buyer or a seasoned investor, sticking to globally recognized mints like the US Mint, Perth Mint, or South African Mint ensures liquidity and authenticity. In 2025, balancing portfolio diversification with gold investment goals will be key to maximizing returns.

Professional illustration about American

Gold Coin Storage Tips

Gold Coin Storage Tips

Proper storage is critical for protecting your gold bullion coins, whether you own American Eagle, Canadian Gold Maple Leaf, or South African Gold Krugerrand coins. The right storage method ensures your precious metals retain their value, purity, and condition over time. Here’s how to store your gold coins securely while maximizing wealth protection.

Choose the Right Storage Environment

Humidity, temperature fluctuations, and exposure to air can tarnish or damage gold coins. Store them in a cool, dry place with stable conditions—avoid basements or attics where moisture levels vary. For high-value coins like the American Buffalo or Chinese Gold Panda, consider airtight containers with silica gel packs to absorb excess moisture.

Use Protective Holders

Gold coin designs can scratch easily, so always handle them by the edges. For individual coins, use inert plastic flips, capsules, or archival-quality Mylar sleeves. If you own Perth Mint or Austrian Mint coins, check if they come in sealed assay cards, which provide extra protection. For bulk storage, padded coin tubes or fabric-lined boxes prevent scratches and dings.

Secure Storage Solutions

If you’re holding gold bullion coins as part of portfolio diversification, a home safe or bank safety deposit box is ideal. Fireproof safes with high-security ratings are recommended for American Gold Eagle or British Gold Britannia collections. For larger holdings, third-party vaulting services specializing in precious metals offer insured, climate-controlled storage—perfect for gold IRA investments.

Insurance and Documentation

Even with secure storage, insure your gold coins against theft or damage. Keep detailed records, including purchase receipts, gold coin weights, purity levels (e.g., .9999 for Canadian Gold Maple Leaf), and serial numbers if applicable. Photograph each coin, especially rare ones like the Mexican Gold Libertad, to simplify claims.

Avoid Common Mistakes

Never clean your gold coins—it can reduce their numismatic value. Also, be wary of PVC-based holders, which can cause chemical reactions over time. If you track the live gold prices or gold spot price, remember that improper storage can lead to gold premiums dropping due to damage.

By following these tips, your gold investment will remain pristine, whether you’re storing South African Mint classics or modern US Mint releases. Proper care ensures your bullion coins stay in top condition for years to come.

Professional illustration about Mint

Gold Coin Authentication

Gold Coin Authentication: How to Verify the Real Deal in 2025

Authenticating gold coins is a critical step for investors and collectors alike, especially with the rising popularity of gold bullion coins like the American Eagle, Canadian Gold Maple Leaf, and South African Gold Krugerrand. With counterfeiters becoming increasingly sophisticated, knowing how to verify authenticity can save you from costly mistakes. Here’s a deep dive into the key methods and tools for ensuring your gold coins are genuine.

1. Start with the Source: Trusted Mints Matter

2. Examine Physical Characteristics

Authentic gold bullion coins have distinct physical traits:

- Weight and Dimensions: Use a precision scale and calipers to verify the coin’s weight and diameter. For instance, a 1-oz American Buffalo should weigh exactly 31.1035 grams with a diameter of 32.7mm.

- Purity Marks: Look for stamps like .9999 for the Canadian Gold Maple Leaf or .9167 for the South African Gold Krugerrand, indicating gold content.

- Magnet Test: Gold is non-magnetic. If a coin sticks to a magnet, it’s likely a fake.

3. Advanced Authentication Tools

For high-value coins like the American Gold Eagle or Gold Krugerrand, consider investing in professional tools:

- Ultrasonic Testers: Measure the coin’s density to confirm purity.

- Sigma Metalytics: A handheld device that verifies gold content using electromagnetic waves.

- Microscopic Inspection: Counterfeit coins often have blurry details or uneven surfaces when viewed under magnification.

4. Spotting Red Flags

Be wary of deals that seem too good to be true, especially with gold coins for sale at prices significantly below the gold spot price. Common signs of fakes include:

- Incorrect fonts or misspelled words (e.g., “Liberty” on a fake American Eagle).

- Poorly defined edges or inconsistent reeding.

- Unusual color or sound (real gold has a distinct “ping” when struck).

5. Documentation and Certification

Coins graded by organizations like PCGS or NGC come with tamper-proof holders and authenticity guarantees. For raw coins, request original packaging or certificates of authenticity, especially for rarer issues like the Austrian Mint’s Philharmonic series.

Why Authentication Matters for Gold Investment

Beyond avoiding fraud, proper authentication ensures your gold bullion coins retain their value for wealth protection and portfolio diversification. Whether you’re stacking American Eagles or diversifying with Chinese Gold Pandas, taking the time to verify authenticity safeguards your precious metals holdings. In 2025, with live gold prices fluctuating, knowing your coins are genuine provides peace of mind in an unpredictable market.

Pro Tip: Stay updated on counterfeit trends by following mint announcements and dealer forums. For example, the US Mint regularly issues alerts about fake American Buffalo coins circulating in the market. By combining physical checks with technology, you can confidently build a collection of authentic gold coins that stand the test of time.

Professional illustration about Austrian

Gold Coin Market Trends

The gold coin market in 2025 continues to thrive as investors seek wealth protection and portfolio diversification amid economic uncertainties. Gold bullion coins like the American Gold Eagle, Canadian Gold Maple Leaf, and South African Gold Krugerrand remain top choices due to their recognized purity (typically .9999 fine gold) and liquidity. The US Mint and Perth Mint have seen increased demand for their products, particularly the American Buffalo and Australian Kangaroo series, as collectors and investors alike value their intricate designs and government-backed authenticity.

One notable trend is the rising popularity of gold coins for sale in smaller denominations (1/10 oz or 1/4 oz) as live gold prices hover near record highs, making fractional coins more accessible. The Chinese Gold Panda and Mexican Gold Libertad have gained traction due to their annual design changes, appealing to both numismatists and those hedging against inflation. Meanwhile, the British Gold Britannia has introduced advanced security features like micro-engraving, setting a new standard for counterfeit prevention.

Market dynamics show that premiums over spot gold price vary significantly by mint. For example, Austrian Mint’s Philharmonics often trade at lower premiums compared to limited-edition releases from private refiners. Savvy buyers monitor gold price charts to time purchases during dips, especially for bulk acquisitions of Gold Bullion Coins. The gold IRA segment has also expanded, with custodians now offering more flexible storage options for physical coins like the American Eagle or Gold Krugerrand.

Regional preferences persist: European investors favor the Austrian Mint’s products, while North Americans dominate trading volumes for the US Mint’s offerings. In Asia, the Chinese Gold Panda commands premium pricing due to cultural affinity. Interestingly, secondary markets for vintage coins (pre-2020 issues) from mints like the South African Mint show stronger resilience to price volatility, making them a strategic gold investment for long-term holders.

Technological advancements are reshaping the industry, with some mints experimenting with blockchain-based certificates of authenticity for coins like the Canadian Gold Maple Leaf. Meanwhile, environmental concerns have pushed mints like the Perth Mint to adopt sustainable refining practices, a selling point for ESG-conscious investors. For those new to the market, experts recommend starting with widely recognized coins (e.g., American Gold Eagle or Gold Krugerrand) before exploring niche options like the Mexican Gold Libertad, which carries higher premiums but offers unique artistic value.

The interplay between gold coin purity standards and investor psychology remains fascinating. While most modern bullion coins meet .9999 purity, classics like the Gold Krugerrand (.9167 fine) maintain demand due to historical prestige. Weight options have also diversified beyond 1 oz—the British Gold Britannia now offers 1/40 oz versions, catering to micro-investors. As central banks continue accumulating gold, retail interest in physical coins as a wealth protection tool shows no signs of slowing, particularly for products with dual collectible-investment appeal like the Chinese Gold Panda series.

Professional illustration about Bullion

Gold Coin Collecting Tips

Gold Coin Collecting Tips for Savvy Investors in 2025

If you're diving into gold coin collecting as a wealth protection strategy or simply for the love of precious metals, here’s how to build a smart collection in 2025. Start by focusing on gold bullion coins from reputable mints like the Perth Mint, South African Mint, or the US Mint. These institutions produce high-purity coins with globally recognized designs, such as the American Gold Eagle (22-karat) or the Canadian Gold Maple Leaf (24-karat). Each coin carries intrinsic value tied to the gold spot price, but their collectibility can add gold premiums over time.

Understanding coin purity and weights is crucial. For example, the American Buffalo and Austrian Mint’s Philharmonic coins are 24-karat (99.99% pure), while the South African Gold Krugerrand is 22-karat (91.67% pure) with added durability. Heavier coins (1 oz or more) are ideal for gold investment, but fractional sizes (1/10 oz) offer affordability. Always check the live gold prices before purchasing to avoid overpaying.

Diversify your collection with iconic designs like the Chinese Gold Panda (updated annually) or the Mexican Gold Libertad, which feature unique yearly motifs. The British Gold Britannia is another standout, with advanced security features like micro-textured engraving. For portfolio diversification, consider mixing government-minted coins with historic or limited-edition pieces—just ensure they’re from trusted sources to avoid counterfeits.

Storage and documentation matter too. Store coins in airtight capsules or safes to prevent tarnishing, and keep certificates of authenticity (especially for graded coins). If you’re eyeing a gold IRA, stick to IRS-approved coins like the American Eagle or Gold Krugerrand. Finally, track the gold price chart trends to time your buys strategically. Whether you’re a novice or seasoned collector, these tips will help you navigate the 2025 market with confidence.

Professional illustration about Canadian

Gold Coin vs Bullion

Gold coins and gold bullion are both popular choices for investors looking to diversify their portfolios with precious metals, but they serve slightly different purposes in the world of gold investment. Gold coins, such as the American Gold Eagle, Canadian Gold Maple Leaf, or South African Gold Krugerrand, are minted by government-affiliated entities like the US Mint, Royal Canadian Mint, or Perth Mint. These coins often carry legal tender status, feature intricate designs (like the iconic British Gold Britannia or the annually changing Chinese Gold Panda), and may carry a higher premium over the spot price of gold due to their collectible value. On the other hand, gold bullion typically refers to bars or rounds (often produced by private mints) that are valued primarily for their metal content rather than aesthetic or numismatic appeal. While coins like the Mexican Gold Libertad or Austrian Mint's Philharmonic are technically bullion coins, they bridge the gap between pure investment and collectibility.

When considering gold coins vs bullion, one key difference lies in liquidity and recognition. Government-minted coins like the American Buffalo or Gold Krugerrand are instantly recognizable worldwide, making them easier to sell quickly, especially in smaller denominations (e.g., 1/10 oz or 1/4 oz coins). Bullion bars, while often cheaper per ounce due to lower premiums, may require assays to verify purity when reselling. For investors focused on wealth protection or portfolio diversification, gold coins offer the added benefit of being eligible for gold IRAs, whereas larger bullion bars may not always qualify.

The gold spot price plays a role in both markets, but premiums vary significantly. For example, the American Gold Eagle typically carries a 3–5% premium over spot, while generic 1 oz bullion bars might trade at 1–2%. Collectors and investors should also consider gold coin purity—the Canadian Gold Maple Leaf is 99.99% pure, while the American Gold Eagle is 91.67% gold (with added durability from silver and copper). Storage is another factor: coins in protective capsules take up more space than compact bullion bars, though their smaller sizes (like 1/10 oz coins) allow for more flexible gold investment strategies.

For those prioritizing low-cost exposure to gold, bullion is often the better choice. But if you appreciate history, artistry, or the potential for numismatic appreciation (like limited-edition Perth Mint releases), coins like the Gold Libertad or Gold Britannia add a tangible layer of value beyond mere metal content. Ultimately, the decision between gold coins and bullion depends on your goals—whether it’s pure wealth protection, liquidity, or the joy of owning a piece of minted history. Keep an eye on live gold prices and market trends to time your purchases wisely, and always verify authenticity, especially when buying rare or high-premium coins.

Professional illustration about Krugerrand

Historic Gold Coins

Historic gold coins have long been prized by collectors and investors alike, offering a tangible connection to the past while serving as a reliable store of value. From the iconic American Eagle and American Buffalo coins minted by the US Mint to the globally recognized Canadian Gold Maple Leaf and South African Gold Krugerrand, these pieces are more than just gold bullion coins—they’re artifacts of economic and cultural history. For example, the Gold Krugerrand, first introduced in 1967 by the South African Mint, was the world’s first modern gold bullion coin, revolutionizing the way people invest in precious metals. Its durable 22-karat gold composition and distinctive springbok design make it a standout in any collection.

The American Gold Eagle, launched in 1986, remains one of the most sought-after gold coins for sale, thanks to its iconic Lady Liberty and eagle designs, along with its .9167 purity (22-karat). Similarly, the American Buffalo, introduced in 2006, was the first .9999 pure (24-karat) gold coin produced by the US Mint, appealing to those who prioritize gold coin purity. Across the Atlantic, the British Gold Britannia has evolved since its 1987 debut, now featuring advanced security features like micro-text and radial lines, making it both a wealth protection asset and a marvel of modern minting technology.

For investors focused on portfolio diversification, historic gold coins offer a unique blend of gold investment stability and collectible value. The Chinese Gold Panda, issued annually by the People’s Bank of China, changes its panda design every year (except for 2001 and 2002), making earlier editions highly desirable. Meanwhile, the Mexican Gold Libertad, produced by the Mexican Mint, is celebrated for its high purity (typically .999 fine) and stunning depictions of Winged Victory and Mexican national symbols.

The Perth Mint and Austrian Mint also contribute to this rich landscape with their own legendary coins. The Australian Kangaroo (formerly the Australian Gold Nugget) and Austria’s Philharmonic coins are renowned for their craftsmanship and liquidity in global markets. When evaluating historic gold coins, factors like gold spot price, gold premiums, and gold coin weights play a crucial role in determining their investment potential. For instance, older Gold Krugerrands or American Eagles may carry higher premiums due to their rarity, while newer bullion coins often trade closer to the live gold prices.

Whether you’re building a gold IRA or simply expanding your collection, understanding the historical significance and market dynamics of these coins is essential. Tracking the gold price chart and staying informed about minting trends can help you make smarter acquisitions. From the timeless South African Gold Krugerrand to the elegant Canadian Gold Maple Leaf, each historic coin tells a story—and holds enduring value in an ever-changing financial world.

Professional illustration about Krugerrand

Gold Coin Selling Guide

Selling gold coins can be a lucrative venture if done strategically, whether you're liquidating part of your investment portfolio or cashing in on inherited bullion. The first step is identifying what you own—American Gold Eagles, Canadian Gold Maple Leafs, or South African Gold Krugerrands each carry different premiums based on rarity, condition, and mint origin. For example, vintage Perth Mint or Austrian Mint coins often appeal to collectors, while mass-produced bullion coins like the American Buffalo track closer to the live gold spot price.

Timing matters. Monitor gold price charts and sell when the market peaks—precious metals typically surge during economic uncertainty. Consider selling through reputable dealers (avoid pawn shops) who specialize in gold bullion coins; they’ll assess purity (22k vs. 24k) and weight accurately. Coins like the Chinese Gold Panda or Mexican Gold Libertad may fetch higher premiums due to limited annual mintage, whereas common British Gold Britannia coins are valued primarily for metal content.

For larger holdings, explore gold IRA rollovers to defer taxes or auction houses for rare pieces. Always verify dealer credentials—the US Mint and other official distributors maintain lists of trusted partners. Packaging matters too: Original cases/certificates boost resale value. Finally, diversify your approach. Selling a mix of gold coins for sale (e.g., liquidating half your Gold Krugerrands during a rally while holding the rest for long-term wealth protection) balances immediate gains with portfolio diversification.

Pro tip: Clean coins cautiously—harsh polishing can diminish numismatic value. Instead, use soft cloths for gold coin designs with intricate details like the American Gold Eagle’s Lady Liberty. Document everything; buyers pay more for verifiable history. Whether you’re selling one coin or a hoard, understanding these nuances turns random transactions into optimized profits.

Professional illustration about Chinese

Gold Coin Tax Rules

Tax Rules for Gold Coins: What Investors Need to Know in 2025

Investing in gold coins like the American Eagle, Canadian Gold Maple Leaf, or South African Gold Krugerrand can be a smart way to diversify your portfolio, but understanding the tax implications is crucial. In the U.S., the IRS classifies gold bullion coins as collectibles, which means they’re subject to a maximum capital gains tax rate of 28%—higher than the standard rate for stocks or bonds. However, not all gold coins are taxed equally. For example, certain coins like the American Gold Eagle and American Buffalo are considered legal tender, which can offer some flexibility when it comes to reporting gains.

Gold IRA Rules and Tax Advantages

If you’re holding gold coins in a Gold IRA, the tax treatment changes significantly. Contributions to a Gold IRA are typically tax-deductible, and gains grow tax-deferred until withdrawal. However, the IRS has strict rules about which coins qualify. Only coins minted by government-approved entities like the US Mint, Perth Mint, or Austrian Mint—with a minimum purity of .995 fine gold—are eligible. Popular choices include the British Gold Britannia, Chinese Gold Panda, and Mexican Gold Libertad, but always verify the latest IRS guidelines to ensure compliance.

Reporting Requirements and Exemptions

When selling gold bullion coins, you’ll need to report any profits on your tax return. For coins like the Gold Krugerrand or Canadian Gold Maple Leaf, dealers are required to file a Form 1099-B if the transaction exceeds $10,000. However, smaller sales may not trigger reporting, but you’re still responsible for tracking and declaring gains. One strategy to minimize taxes is to hold coins for over a year, qualifying for the long-term capital gains rate (still capped at 28% for collectibles). Additionally, some states exempt precious metals from sales tax—check local laws to see if coins like the American Eagle or South African Mint products qualify.

Premiums, Purity, and Tax Implications

The gold spot price isn’t the only factor affecting your tax bill. Coins often carry a premium over the melt value due to their design, rarity, or minting origin. For instance, the Austrian Mint’s Philharmonic series might trade at a higher premium than the Perth Mint’s offerings. While premiums aren’t directly taxed, they influence your cost basis—the higher your initial investment, the lower your taxable gain when you sell. Always keep detailed records of purchase receipts, including the gold coin purity (e.g., .9999 for the Canadian Gold Maple Leaf) and weight, as these details are essential for accurate tax calculations.

Wealth Protection Strategies

For investors using gold coins as wealth protection, consider holding them in a self-directed IRA or allocating a portion of your portfolio to bullion coins with lower premiums, like the American Buffalo. These coins are highly liquid and widely recognized, making them easier to sell without steep discounts. If you’re concerned about gold price chart volatility, dollar-cost averaging into positions can smooth out entry points and reduce the tax impact of timing the market. Remember, while live gold prices fluctuate daily, your tax obligations are based on the sale price minus the original cost—so meticulous record-keeping is non-negotiable.

Professional illustration about Libertad

Gold Coin Insurance

When investing in physical gold coins like the American Gold Eagle, Canadian Gold Maple Leaf, or South African Gold Krugerrand, insurance is a critical consideration to protect your assets. Unlike digital gold investments, physical bullion carries unique risks—theft, damage, or loss—making specialized coverage essential. Most homeowners' insurance policies have limited coverage for precious metals, often capping payouts at a fraction of your collection's value. For serious investors holding coins from mints like the Perth Mint or Austrian Mint, a separate precious metals insurance policy is highly recommended.

Key factors to evaluate when insuring gold coins:

- Appraisal Requirements: Insurers typically require professional appraisals for high-value coins (e.g., Chinese Gold Pandas or rare Mexican Gold Libertads). Always document your collection with photos, certificates, and purchase receipts.

- Storage Conditions: Coverage may depend on whether coins are stored in a home safe or a bank vault. Some policies exclude losses from unapproved storage methods.

- Market Value vs. Collector Value: While bullion coins like the American Buffalo track gold spot prices, numismatic coins (e.g., vintage British Gold Britannias) may need additional rider policies to account for collectible premiums.

For portfolio diversification, consider insurers specializing in precious metals, such as Lloyds of London or private vault services with integrated coverage. These providers often offer all-risk policies that include theft, mysterious disappearance, and even damage during transit. If you hold coins in a Gold IRA, verify whether your custodian’s insurance meets IRS requirements—some mandate segregated storage with third-party coverage.

Pro Tip: Regularly update appraisals, especially after significant market shifts. The gold price chart can fluctuate dramatically, and undervalued insurance leaves you exposed. For example, a 1-ounce Gold Krugerrand purchased at $1,800 might now be worth $2,500 due to live gold prices—but your policy must reflect this.

Lastly, compare premiums (typically 1-2% of the insured value annually) and exclusions. Some policies exclude "unattended theft" (e.g., coins stolen from a car), while others cover global transit—a must if you trade coins internationally. Whether you own gold bullion coins for wealth protection or rare editions, tailored insurance ensures your investment stays secure.

Professional illustration about Britannia

Gold Coin Scams Alert

Gold Coin Scams Alert: How to Spot and Avoid Fraud

The gold coin market is booming in 2025, with investors flocking to Gold Bullion Coins like the American Gold Eagle, Canadian Gold Maple Leaf, and South African Gold Krugerrand for wealth protection and portfolio diversification. However, this surge in demand has also led to a rise in sophisticated scams targeting both new and seasoned buyers. Here’s what you need to watch out for:

Counterfeit Coins – High-quality fakes of popular coins like the American Buffalo or Chinese Gold Panda are flooding the market. Scammers use advanced techniques to mimic the weight, design, and even the gold purity of genuine coins. Always verify coins through reputable dealers or grading services like the US Mint or Perth Mint.

Fake Dealers – Unlicensed online sellers often advertise gold coins for sale at prices far below the gold spot price, luring buyers with too-good-to-be-true deals. Stick to established mints like the Austrian Mint or British Gold Britannia suppliers, and avoid sellers who pressure you into quick purchases or refuse to provide certification.

Bait-and-Switch Tactics – Some fraudsters advertise authentic Gold Bullion Coins but ship inferior products or even gold-plated replicas. Always inspect purchases upon delivery, checking for inconsistencies in gold coin designs or packaging. For example, the Mexican Gold Libertad should have specific security features, like micro-engraved details.

Misleading IRA Schemes – Scammers promote fraudulent gold IRA plans, claiming tax benefits while charging exorbitant fees or selling overpriced, low-quality coins. Legitimate precious metals IRAs only include approved coins, such as those from the US Mint or South African Mint. Always consult a financial advisor before committing.

Spot Price Scams* – Be wary of dealers who quote prices significantly below the live gold prices. This often indicates counterfeit products or hidden fees. Reputable sellers transparently display premiums over the gold price chart and explain additional costs upfront.

Protect yourself by doing thorough research, sticking to trusted sources, and verifying certifications. The allure of gold investment is strong, but vigilance is key to avoiding costly scams.